References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and to the California Revenue and Taxation Code RTC. If your federal foreign tax credit on non-business income is less than the related tax you paid to a foreign country you may be able to claim a.

How To Track Your Small Business Expenses 4 Easy Tips

Penalties for filing late and appeals.

. January 1 2019 Stock Basis. General scheme of corporation tax. For the self-employed HMRC will look at the existing trade.

Contains the comparison of FY 207879. Wisconsin Manufacturers Sales Tax Credit Carryforward Allowable Instructions. Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1Add the taxable items and the non-allowable expenses listed on lines 101 to 199 and subtract from this the non-taxable items and.

Wisconsin Non-Combined Corporation Franchise or Income Tax Return Fill-In Form. Except for taxpayers earning compensation income arising from personal services rendered under an employer-employee relationship where no deductions shall be allowed under this Section other than under Subsection M hereof in computing taxable income. To calculate the corporate income tax you need to find out the profit after deducting all the allowable expenses and deductables from the gross profit.

TC-20S Schedule A line 9. The return was filed on June 30 but the corporation did not pay the tax due of 2000 until July 10th. Chapter 1 The charge to corporation tax.

Provided the training undertaken is to update professional skills and expertise relating to the business then this expenditure is normally tax deductible. Exclusion of charge to income tax. Additional rate taxpayers even more.

Part 2 Charge to corporation tax. Deductions from Gross Income. Is dealt in section 172 of the Income Tax Act as perquisite.

26 Interest expense deducted in computing non-Utah taxable income see instructions 27 Indirect related expenses for non-Utah nonbusiness income - multiply line 25 by line 26 28 Total non-Utah nonbusiness income net of expenses - subtract line 27 from line 20 Enter on. TC-20 Schedule A line 7. Interest expenses relating to non-income producing assets are not tax-deductible.

Use Schedule 1 to reconcile the net income loss reported on your financial statements and the net income loss required for tax purposes. The United States currently levies a flat 21 corporation tax on the Taxable Income of the registered companies. A corporations income tax return was due on April 15.

If you decide to operate your business as a corporation the corporation can elect to deduct up to 5000 of its organizational expenditures and amortize the remainder over a period of 180 months. The loss and deduction items are pro-rated to determine the amount currently allowable. You will be given an automatic deduction for this against your tax at basic rate but since 6th April 2020 it is no longer allowable for higher rate tax relief.

Buy-to-let allowable expenses and non allowable expenses those expenses you CANNOT claim a deduction for include. If you are a higher rate taxpayer you pay 40 on your rental profits. The whole amount of expenses incurred by the employer will be allowable expenditure to such employer under Income Tax Act.

The tax due was more than 10 of the total tax liability for the year so the corporation. Updated Income Tax rates in Nepal for 20792080 Individual and Couple. Line 81 Total ESOP and EVCC tax credits.

Below is the chart. 2020 Instructions for Form 100W California Corporation Franchise or Income Tax Return Waters-Edge Filers. Chapter 2 Rates at which corporation tax on profits charged.

When your company has interest expenses that are attributable to non-income producing assets it has to make interest adjustments in its tax computation. Charity donations on tax returns. How to register and file a tax return online.

In 2017 the US corporation tax rate was reduced from 35 to 21. How to pay your tax. Accountant helps strategist Kerry Needs focus on core strengths.

At the March 2021 budget the Chancellor announced plans for a rise in the headline rate of Corporation Tax to 25 from April 2023. Overview of the Corporation Tax Acts. Tax deductions are a form of tax incentives along with exemptions and tax creditsThe difference between deductions exemptions and credits is that deductions and exemptions both reduce taxable income while.

Training tax relief for the self-employed and sole traders. Final thoughts on filing a tax return online. British Columbia employee venture capital corporation tax credit.

The main reason landlords use a company to invest in property is the benefit of taking advantage of corporation tax rates and dividend tax rates which are lower than income tax. The government charges a corporation tax on the profits. Charge to corporation tax.

Specify the status of hospital. Interest expenses normally accrue on a debt liability eg. Amount of profits to which corporation tax rates applied.

Exclusion of charge to capital gains tax. Differences between California and Federal Law. Charge to tax on profits.

Expenses should be reported when filing your self-assessment tax return. Chapter 3 Calculation of amount to which rates applied. The currency to be used.

Line 58729 Allowable amount of medical expenses for other dependants. Why business owners may use an accountant and how much they cost. Where a particular deductible item is not directly traceable to Massachusetts source income as may be the case for certain employee business expenses the non-residents applicable deduction amounts must be totaled and apportioned to Massachusetts using the applicable rules for apportionment of income set forth in 830 CMR 625A15 6.

To assist you in understanding disallowable expenses for Corporation Tax we have compiled this guide to make it easier for you to ascertain your Corporation Tax liability. Lets start with the main attraction. 2020 Corporation Tax Forms.

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses particularly those incurred to produce additional income. Of course if you have any further questions regarding your companys requirements in any aspect of accounting please do not hesitate to get in touch with the team at. Wisconsin Department of Revenue.

On average corporations pay 2589 for local state and federal taxes. The S corporation makes a non-dividend distribution to the shareholder. Title II Income Taxation CHAPTER VII Allowable Deductions SECTION 34.

Net section 1231 gain. Tax Rates Slabs and Rules. The Corporation Tax rate for company profits for the 202223 tax year is 19 a business with 100000 in annual profit will pay 19000 in Corporation Tax.

Non-deductible expenses reduce a shareholders stock andor debt basis before loss and deduction items. Non-Life Insurance 30. The 5000 deducted for organizational expenses must be reduced by the amount by which the expenses exceed 50000.

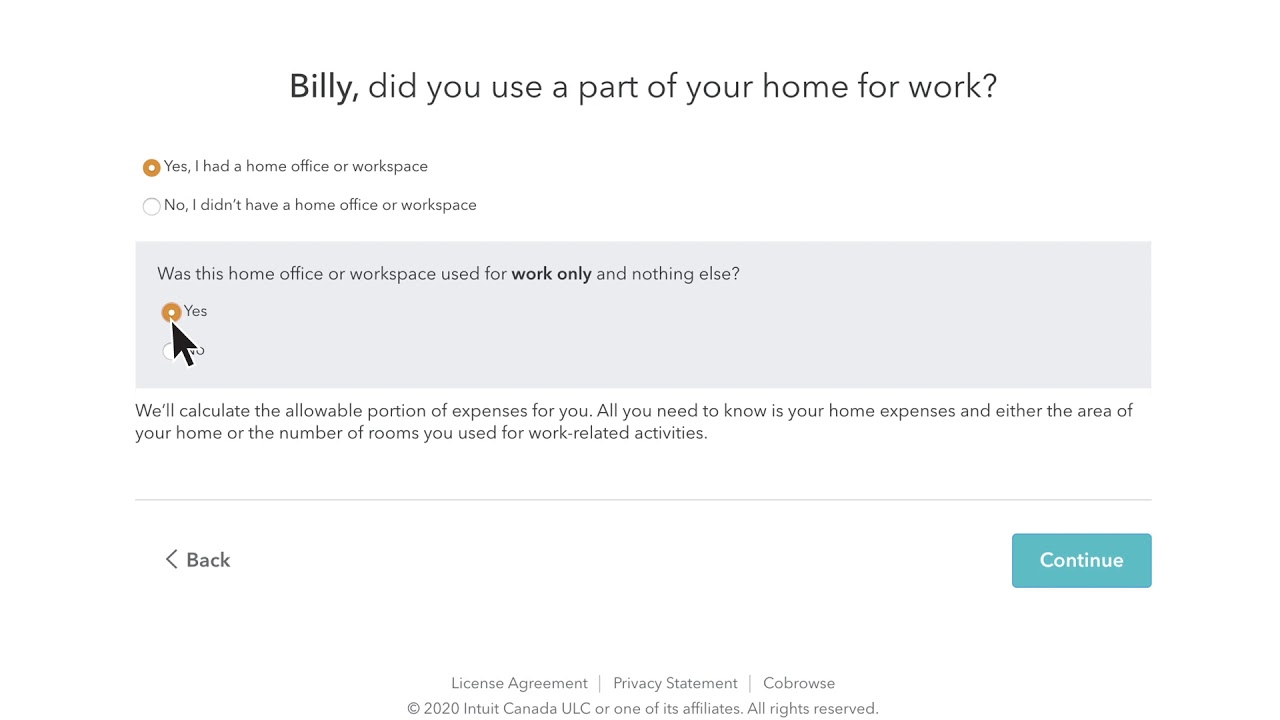

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Claiming Carrying Charges And Interest Expenses 2022 Turbotax Canada Tips

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

What Are Selling Expenses Bdc Ca

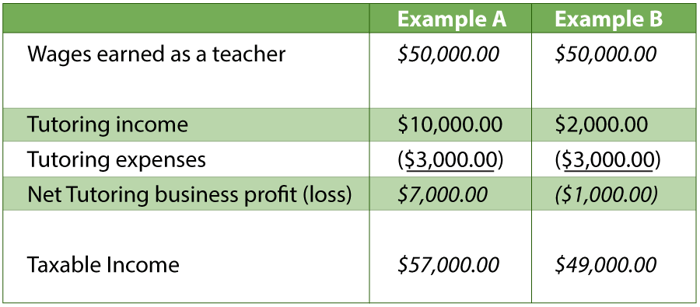

When Can You Claim Business Expenses And How To Calculate Them

12 Month Rule For Prepaid Expenses Overview Examples

Tax Shield Formula Step By Step Calculation With Examples

Corporate Income Tax Deductibility Of Expenses Youtube

How To Set Up A Limited Company Visual Ly Limited Company Company Structure Limited Liability Company

4 Tax Tips For Small Business Owners Tips Taxes Business Small Business Tax Small Business

Tax Deductions For Small Businesses In Canada Srj Chartered Accountants Professional Corporation

A Beginner S Guide To The Cra S T2125 Business Expenses Bredin Digital

Automating Mileage Claims In The Uk Mileage App Mileage Tracking App About Uk

6 Common Miscellaneous Expenses Examples Tax Deduction Tips For Small Businesses

What Are Some Self Employed Tax Deductions In Canada

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Two Ways To Write Off Your Vehicle Expenses

10 Creative But Legal Tax Deductions Howstuffworks